Suppose The At-fault Vehicle Driver Has Insufficient Insurance To Cover All My Problems?

Furthermore, some states operate under the concept of comparative oversight, which means damages are reduced in proportion to the level of oversight. For instance, if one celebration is discovered to be 75% in charge of an accident, they will certainly be accountable for paying for 75% of the damages. Going into discount information, I found that State Ranch has the greatest discount (23%) for bundling home and automobile insurance coverage, but American Family (18%) and Farmers (18%) likewise provide excellent insurance packing discount rates.

State minimum protection rates mirror the minimum quantity of auto insurance needed in each state. Insurance firms also evaluate other elements such as gender, age, occupation, marriage standing, home ownership and credit report. For example, California, Hawaii, Massachusetts and Michigan ban making use of credit rating in cars and truck insurance quotes. You'll pick an insurance deductible amount-- the quantity your insurer deducts from an insurance claim check-- when you purchase accident and extensive insurance policy. A $500 deductible is one of the most typical option, yet you can save cash by increasing your car insurance policy deductible. Our analysis found that the ordinary auto insurance price boost for motorists with a drunk driving is 71%.

Compare Auto Insurance Policy Rates 2025

If it functions, the most effective service to discovering the at-fault chauffeur's plan limitations is just to ask the other driver to see if they'll offer the information. If they have been instructed not to talk with you by their insurance adjuster, try asking the adjuster. Nonetheless, insurance companies are not generally required to divulge plan restrictions in liability claims upon demand.

Attorney's Approach

- You might additionally get fined and have your cars and truck taken away, regardless of that caused the crash.Knowing your insurance coverage, comprehending your lawful rights, and doing the best things can likewise assist you recover economically.After an automobile accident, your finest strategy is to report the accident to your automobile insurance company and figure out exactly how your insurance coverage applies.Depending on your state, uninsured vehicle driver insurance may cover damages if you're the target of a hit-and-run.Basically, the shedding side in car crash arbitration is usually stuck with the choice.

If any person is seriously injured, medical prices can in some cases surpass $50,000 in a solitary day. Driving without insurance policy lugs legal and financial consequences that vary by state. Fines for a first violation range from $100 to over $1,000, with repeat infractions bring about steeper charges, occasionally surpassing $5,000.

Make A Decision How Much Cars And Truck Insurance You Need

This is an important action, particularly when handling an uninsured at-fault motorist. This guide is your beacon via the fog, enlightening alternatives you might not recognize you have and approaches to safeguard your legal rights. Keep reading to uncover how this knowledge can encourage you and offer clarity and hope in a circumstance that usually feels anything yet clear. The typical insurance claim repayment for for injuries is $36,289, according to the National Organization of Insurance Commissioners (NAIC).

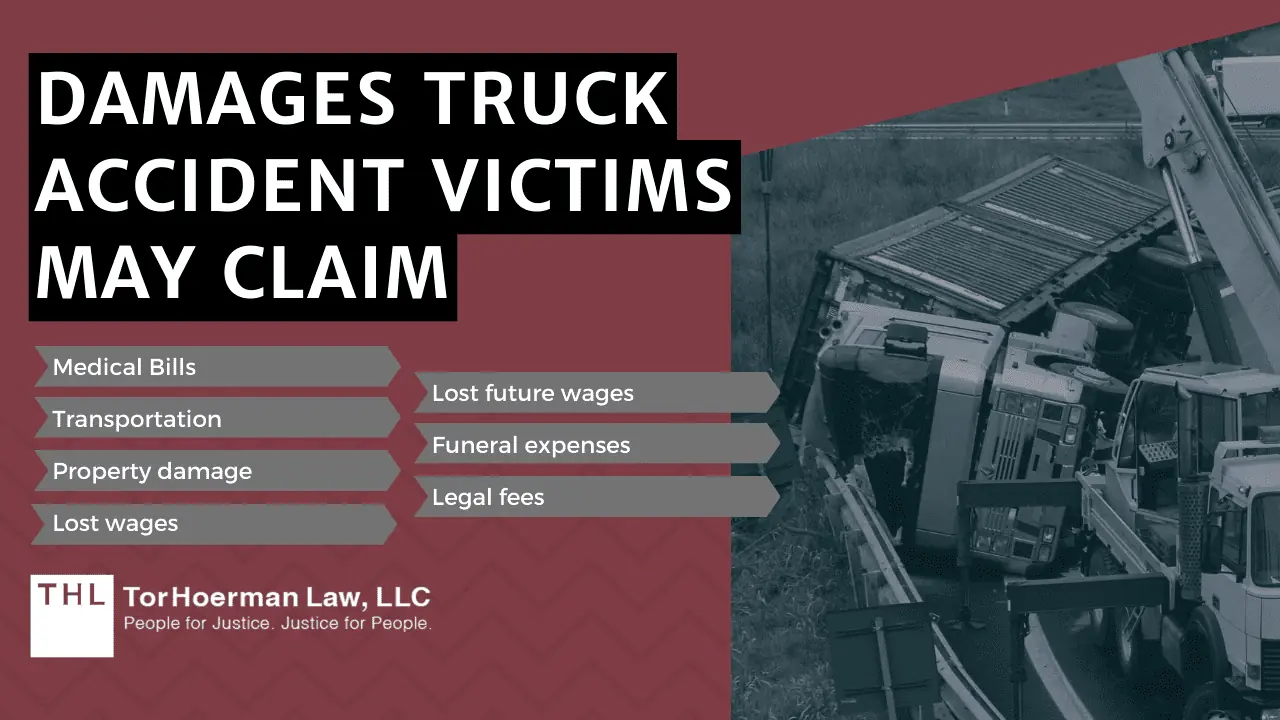

This could entail taking legal action against the at-fault vehicle driver directly and looking for problems for clinical expenditures, lost earnings, discomfort and suffering, and various other related costs. The claim can demand settlement for medical expenses, home damages, and pain and suffering. Nonetheless, accumulating on a judgment can be testing if the at-fault vehicle driver does not have the financial resources. Your lawyer can check out all available alternatives, including wage garnishment or https://johnathanhpby711.cavandoragh.org/what-happens-if-the-at-fault-vehicle-driver-has-insufficient-insurance-to-cover-all-my-damages confiscating possessions, to impose the judgment and secure the payment you are qualified to. Even if Auto accident lawyer with high success rate it is lawfully required doesn't suggest all drivers have it. When an at-fault driver in a crash does not have insurance coverage, it complicates the scenario for all parties entailed.

To deal with the complications, the victim should take into consideration filing an authorities report, looking for compensation from their insurance policy, and potentially launching a personal injury lawsuit. If the chauffeur who triggered the mishap does not have insurance policy, you might have to pay for the problems. The injured party or their insurance coverage could try to get money from the without insurance driver. This can trigger financial and legal troubles for the vehicle driver, even if they weren't to blame. Understanding if someone's plan limits suffice to cover a crash can be very helpful as you consider your negotiation demands. In states that call for uninsured motorist insurance coverage, you'll require it whether or not you have medical insurance. If your state doesn't require it, you might not require it if you have good health insurance policy, yet it deserves considering if you have a big health plan insurance deductible, copays and coinsurance. You'll require to additionally contend the very least a fundamental car insurance policy obligation plan. If your state requires uninsured vehicle driver coverage, you should purchase the very least the state's minimum. Your restriction will commonly be a quantity that matches your obligation protection amounts. So, if you choose greater liability limits, your limits will certainly likewise be greater.